Why Are Bankruptcies so Expensive?

Professional Fees in Chapter 11

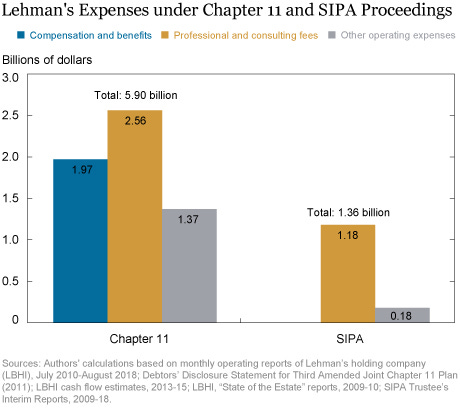

In 2019, the Federal Reserve released a formal analysis of total expenses associated with the Lehman Brothers bankruptcies. The biggest expense were fees paid to bankruptcy professionals, totaling nearly $2.6 billion for the Chapter 11 case and another $1.36 billion for the SIPA case. $4 billion went to lawyers, consultants, and bankers as part of the case. One law firm earned $424 million as part of the SIPA proceedings from 2008 to 2022.

The $18 billion bankruptcy of Las Vegas-based Caesar’s Palace netted bankruptcy professionals over $500 million in aggregate.

Advisors in the FTX bankruptcy billed over $200 million from November 2022 through June 2023 and the process is ongoing.

Corporate bankruptcies are a lucrative business.

Here’s why.

When a company is gearing up for a bankruptcy, the company and creditor constituents will bring on:

Lawyer(s)

Investment banker

Restructuring consultant

Each of these advisors fulfill an important role and are compensated differently. Restructuring bankers will typically receive a monthly retainer plus a success fee. A success fee could be a simple flat fee, a percentage of transaction value, a fee for financing, or even a fee resulting from specific outcomes such as the sale of certain assets.

Operational consultants will make a team available to their client which consists of a Managing Director, Director, and Associates/Analysts. The debtor’s consultant would put in place the Chief Restructuring Officer. Operational consultants are the “boots on the ground” in a restructuring, responsible for developing an in-depth understanding of a company’s cash flow profile. Unlike bankers, consultants often spend considerable time on-site with the company developing analyses such as a 13-week cash flow model. Operational consultants are compensated on an hourly basis.

Bankers are the transaction experts, advising on the capital structure, forms of consideration, and financing. Consultants are the operational experts, dealing with sales, costs, cash flow management, and turnaround planning. In some instances with high industry-specific complexity, technical consultants may be brought on in addition to a restructuring consultant.

Last but certainly not least, restructuring and insolvency lawyers provide legal expertise in bankruptcies. Lawyers are often the first to be hired as a company approaches the realm of distress.

These advisors comprise the bulk of the fee burn and are the key players driving a restructuring process.

To understand how fees can add up, let’s walk through the fees from the bankruptcy of Caesar’s Palace.

The biggest rake went to Kirkland & Ellis, the lawyers representing the debtor, who collected $77 million in fees. This amount doesn’t include the $16.5 million Kirkland earned advising Caesar’s operating company CEOC over the six month period prior to the bankruptcy filing. CEOC’s restructuring consultant AlixPartners pulled in over $45 million over the course of the bankruptcy case. The investment banker Millstein & Co. got the short end of the stick, making only $7 million! Heck, even KPMG pulled $10 million from their role as tax consultants. C’mon now.

Unless you work in the sector or have dealt with a bankrupt investment, you probably don’t know that the fees of the advisors to most of the constituents in a bankruptcy are also paid for by the company.

In other words, the lawyers, bankers, and consultants of the creditors are also paid by the estate (subject to court approval). In complex cases with multiple creditor classes, these fees add up fast.

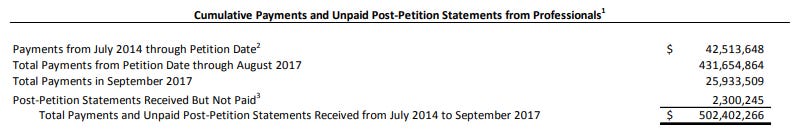

Caesar’s emerged from bankruptcy in October 2017. The last schedule of payments to restructuring professionals is available through September 2017. By this point, bankruptcy professionals had drummed up over $500 million in fees, $42.5 million of which were incurred prior to the company filing for bankruptcy. The fee burn averaged ~$14 million per month during the bankruptcy.

Here’s a list that includes most of the firms that were retained:

Note that the list above is not exhaustive. In particular, it excludes the advisors of CEOC’s parent company Caesar’s Entertainment (Blackstone [PJT], Paul Weiss), Caesar’s Acquisition (Moelis, Skadden), and strategic advisors to CEC’s Board of Directors (Centerview, Reed Smith).

Lawyers were the big winners in this case. Lawyers and consultants are compensated hourly, whereas bankers get the bulk of their fee once a deal is closed. Cases that drag on tend to benefit law firms and consultants more than the bankers. Bankers are highly incentivized to bring constituents to an agreement so that a transaction can be consummated and they can get paid.

High professional fees are associated with:

Long, drawn out bankruptcies

Complex capital and organizational structures

Disagreements among constituents

Caesar’s was unique because it was a highly contentious bankruptcy case that highlighted the lengths to which private equity firms would go to recover value. The case is famous for pitting well-known investors against each other. The distressed investing space and private equity industries are a small world. The same funds come across each other on deals and investments repeatedly. On the advisor front, you’ll see the same handful of firms in every major corporate bankruptcy.

While the industry is extremely competitive and distressed situations are naturally adversarial, you may not want to totally screw over your counterparties so you can still do business with them in the future.

This sentiment went out the door after the Caesar’s Palace case when sponsors Apollo and TPG aggressively exploited loopholes in the debt documents to divert value away from creditors and protect the value of their own position.

The situation was (at the time) regarded as an extreme case of “violence” among institutional investors, even for the bankruptcy world. If you’re interested in learning more, there is plenty of literature and media coverage on this case. We came across this thread which provides an excellent synopsis.

Corporate bankruptcies are high stakes situations with tens of billions of dollars (and people’s careers) at stake. Caesar’s is one of the most prominent examples of the knife fighting that has become common in the distressed space over the years.

You now know how professional fees reach exorbitant amounts in bankruptcies.

The question that remains is why do people pay these professionals so much?

Here are the top 5 reasons why restructuring professionals are able to command high rates:

The Best of the Best: The amounts of money involved in large corporate bankruptcies are substantial. As a result, there's a lot at stake for all parties involved, and they're often willing to pay for top legal and financial talent to protect their interests. When you have hundreds of millions of dollars on the line, you want to hire the best.

The Price is the Price: Market rates for lawyers, accountants, and financial advisors who specialize in corporate bankruptcy are high. These rates reflect their expertise, experience, and the demand for their services. Kirkland & Ellis is one of the most expensive bankruptcy law firms you can hire, yet they continue to win mandate after mandate using their relationships and reputation to swing big deals.

Complexity of the Case: Large corporate Chapter 11 cases involve complex legal and financial issues that require specialized expertise. Large corporations often have a multitude of stakeholders, including various classes of creditors, shareholders, employees, and sometimes even regulatory bodies. Each group may have different interests and legal rights, and balancing these can be a complex and time-consuming process. Additional complexities ranging from collapsing business operations to dealing with tax implications can make cases more challenging. The more complex the case, the more hours professionals need to work, and the higher the fees.

Duration of the Case: Chapter 11 cases can take a long time to resolve, often years. During this time, professionals are continuously working on the case, which adds to the total cost.

Litigation and Disputes: If there are disputes among creditors or other parties, or if litigation is necessary, this can significantly increase the amount of professional work required, time in bankruptcy, and thus the fees.

Let’s be real. No constituent wants to hundreds of millions of dollars coming out of the estate and going to advisors. However, bankruptcies aren’t always a terrible outcome for everyone. If a group of hedge fund bought up junior bonds at 40 cents on the dollar and received 80 cents in recoveries, they’re not likely to care as much about a few million dollars to their banker because they probably made hundreds of millions!

On the flipside, if the situation at the company deteriorated over the course of the bankruptcy process and those same bonds were worth zero, you can bet there will be a lot more frustration over the fees. Advisors may be asked to lower fees or kick a few bucks back into the estate (don’t hold your breath).

You now have an insider perspective on why bankruptcies are so darn expensive. Stay tuned for the next one!

Appendix

Final fees approved to pay the advisors of the official committees of CEOC

Unsecured Creditors Committee (“UCC”):

Lawyer: Proskauer - $28.7 million

Investment banker: Jefferies - $10.6 million

Consultant: FTI Consulting - $12.5 million

Gaming industry advisor: G.C Andersen - $1.8 million

Second Lien Noteholders:

Lawyer: Jones Day - $25.1 million

Investment banker: Houlihan Lokey - $21.5 million

Consultant: Zolfo Cooper - $8.1 million

Another $32 million was billed by court-appointed examiner Winston & Strawn.

Legal and consulting fees for the first three months of the FTX bankruptcy

The fees above total $85.5 million for the first ~3 months of the FTX bankruptcy. As of June 28, 2023 the total amount has reached over $200 million.

Disclaimer: We are not financial advisors. This content is for educational purposes only and merely cites our own personal opinions. All analysis, including valuation, debt, liquidity, etc. is illustrative in nature and subject to revision.