Is Redfin Going Bankrupt?

The uncertain future of this household name

Sometimes, growing fast isn’t so great for a business. Unexpected rapid growth requires spending on expansion quickly. When revenue is flowing in and cash is easy to come by, companies overspend. Pricey acquisitions, new lines of businesses, and headcount bloat can quickly turn booming years into a precursor for a future default.

Even seasoned management teams can find themselves caught off guard in the froth of a zero interest rate bull market. Worsening macro conditions, high operating expenses, and a fiercely competitive real estate market might just be enough to send Redfin hurtling over the edge.

The stock has collapsed, falling a whopping 91% from its peak February 2021.

The Business

Redfin is a residential real estate brokerage that employs its own real estate agents. As a digital-first business, customers discover Redfin through the company’s website and mobile app where they can browse listings and book tours with Redfin agents.

Redfin differentiates itself from traditional real estate brokerages in a few key ways:

Discounted 1.5% listing fee vs. 2.5-3% for realtors

Realtors manage the entire process whereas Redfin has staff other than agents managing parts of the process (marketing, open houses, documentation, etc.)

Redfin agents are employees and earn salaries, benefits and a flat rate whereas realtors get paid entirely on commission

Redfin’s long-term goal is to act as an end-to-end solution for real estate services including buying, selling, and renting homes, receiving mortgages, and title services. They compete by being cheaper, faster, and providing a superior digital experience compared to traditional brokerages.

The Situation

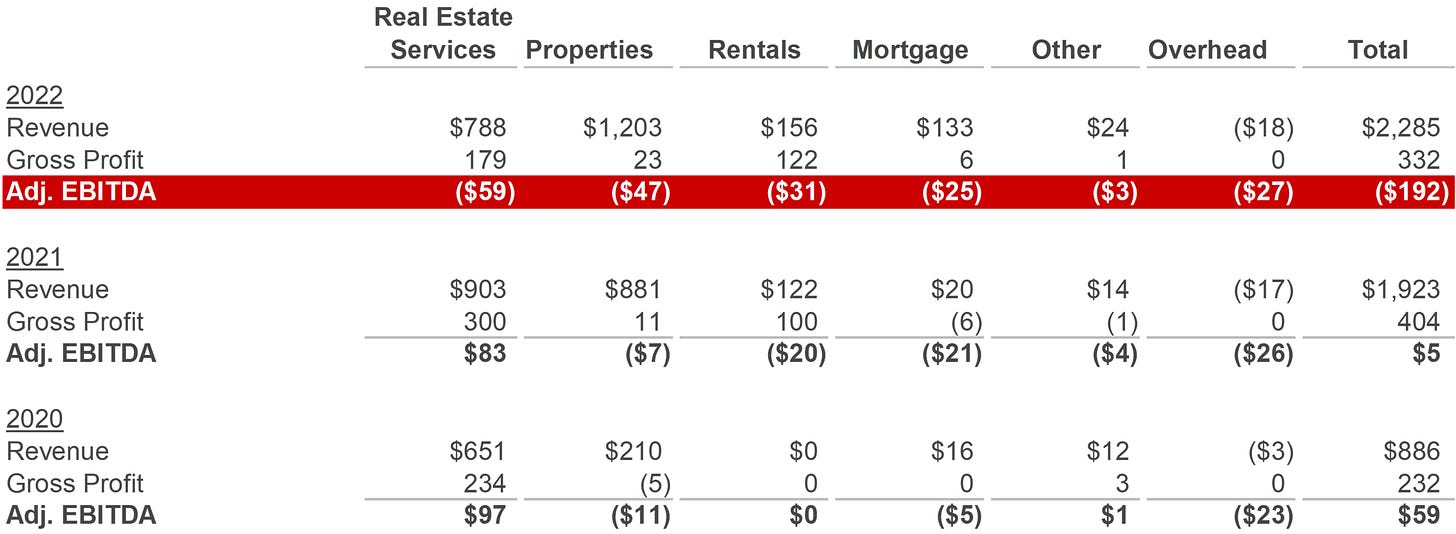

Adjusted EBITDA was -$192mm for 2022. After capex and cash interest, that comes out to $234mm cash flow burn — roughly the same as the amount of cash Redfin had on hand at the end of 2022.

Gross profit margin is down from 26% in 2020 to 13% in 2022. Despite a $1.4B revenue increase over this period, Redfin only generated an incremental $54mm in gross profit.

Q4 2022 revenue fell 25% y-o-y to $480 million and gross profit fell 65% to a mere $37 million.

With the hopes of keeping the lights on, Redfin is making some changes.

Will it be enough?

Just a few days ago, Redfin announced its third round of layoffs in a year, adding another 200 bodies to the 1300+ employees laid off in 2022. The company still has over 5,300 employees.

Redfin agents are employees that receive salaries and benefits. These agents are paid regardless of whether or not agents close deals. Collapsing transaction volumes makes Redfin worse off than traditional brokerages.

Redfin also shuttered RedfinNow, an instant buyer of real estate. The winddown began November 2022 and liquidation will be completed in Q2 2023.

Suffice to say, things are bad. Typically these “turnaround stories” come with some sort of overly ambitious operational restructuring plan that bakes in a gazillion dollars in cost savings into the forecast.

For Redfin, the plan seems to be layoff employees, shutter unprofitable divisions and hope the market recovers.

That’s a bold move Cotton. Let’s see if it pays off.

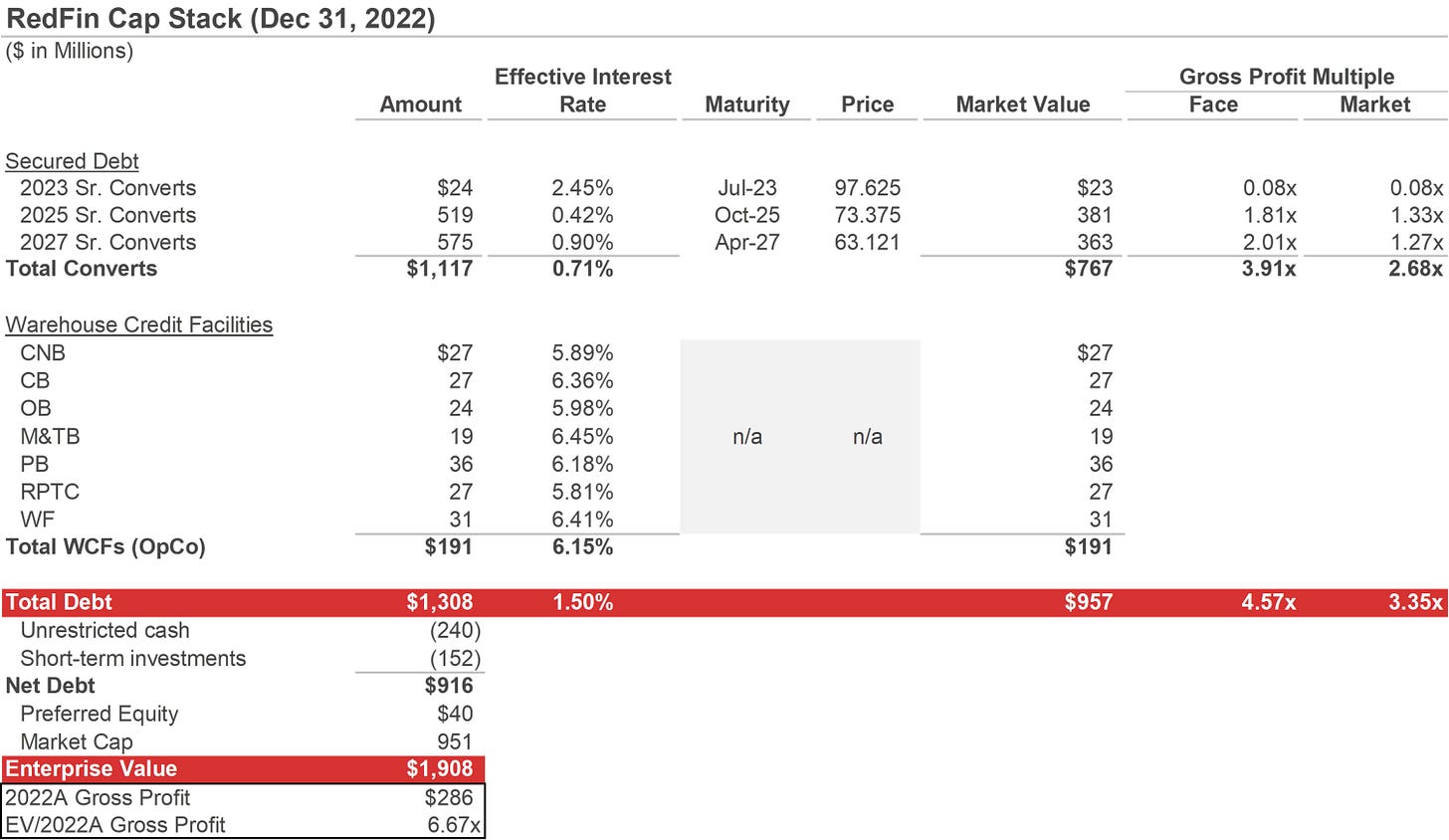

The Cap Stack

Redfin has $1.1B in unsecured senior convertible notes outstanding with a total market value of $767mm. Given where the 2025 and 2027 notes are trading, the market is implying there’s stress, but not necessarily distress. The consensus expectation is that there will be bumps in the road but Redfin should be able to deal with upcoming maturities.

Subsidiary Bay Equity has $191mm in outstanding debt from warehouse credit facilities. These facilities have a combined total of $550mm in borrowing capacity.

A warehouse facility is short-term financing a lender provides to mortgage originators to fund loan closings. Redfin’s borrowings under these facilities are secured by the mortgage loan.

Bay Equity is Redfin’s mortgage business. The business uses warehouse credit facilities to fund originations then sells the mortgage business in the secondary market to paydown the facilities. It’s a relatively new business for Redfin, acquired in April 2022 for $138mm.

Redfin also paid $608 million to acquire a company called “RentPath” in April 2021 for rental searches. This includes ApartmentGuide.com, Rent.com and Rentals.com. The rentals segment earns revenue primarily through subscription offerings for listing services.

The properties segment consists of revenue Redfin earns from the sale of homes bought from sellers on the platform (RedfinNow).

Debt Maturities

Redfin’s house is on fire, but the company doesn’t have a large maturity until the October 2025 maturity of convertible notes. They should be able to extinguish the $24mm due in July 2023 without a sweat.

There’s also $40mm in preferred equity that has to be repaid in Q4 2024. The holder can elect to receive payment in Redfin common stock, cash, or a combination.

Without a substantial improvement in the prospects of its core business Redfin will not be able to refi or otherwise manage its 2025 converts repayment. The company will be forced to find a solution with lenders.

A lot can change in two years, however. What about before then?

Redfin had $240mm in unrestricted cash and $152mm in short-term investments at the end of 2022. These investments consist of cash in financial institutions, money market instruments, U.S. treasuries and agency bonds. We’re comfortable including these investments as part of Redfin’s liquidity.

That brings us to $392mm in total liquidity.

Here’s a quick n’ dirty back of the envelope estimate for 2023 liquidity if we assume the same cash flow from 2022.

Not the worst we’ve seen. Based on 2022 cash flows, Redfin has ~19 months of runway net of the 2023 notes. The 2025 and 2027 notes have low interest rates, so their drag on liquidity is minimal until they mature. Redfin has been buying back and retiring debt, including $142.5mm of the 2025 notes in Q4 2022.

Here’s the thing: 2023 Redfin is going to look a lot different from 2022 (except for the part where they burn tons of cash).

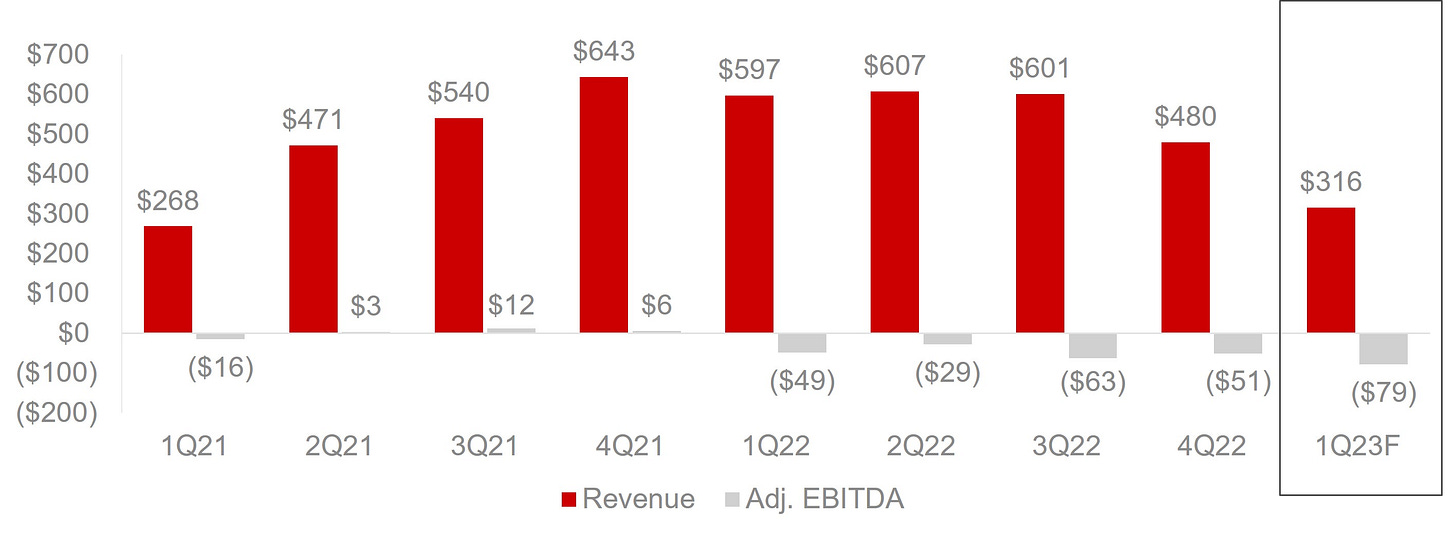

Management expects an adjusted EBITDA loss of $84mm to $73mm in Q1 2023, compared to $49mm in Q1 2022.

The upside down hockey stick chart is taking shape. Redfin and its shareholders will have to hope this stick gets knocked upright to stand a chance.

Unfortunately for them, 1H23 volumes are likely to be stronger than the second half from a seasonality perspective. Considering that another 200 employees were laid off in April, Q2 probably isn’t going so well.

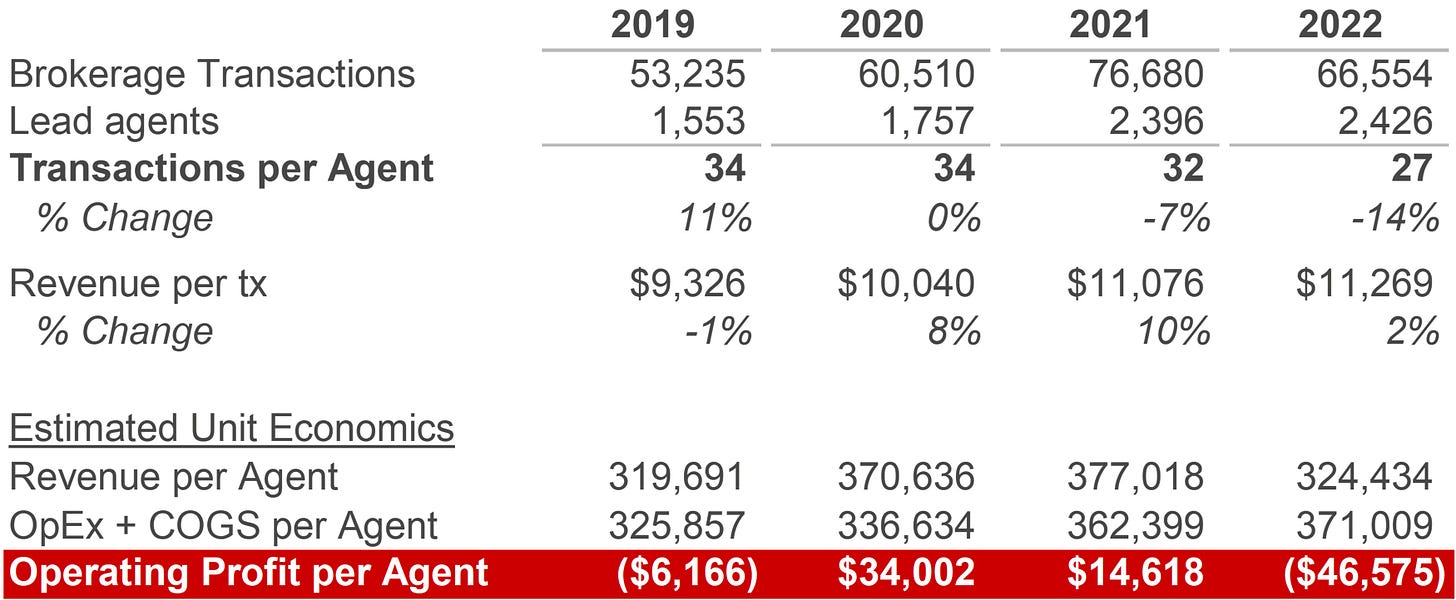

Even if the market were to stabilize, Redfin’s business is unlikely to turnaround quickly enough. There are issues inherent to the business model. Redfin provides a discounted service with a cost structure that’s worse than competitors.

The company boasts that Redfin agents get paid 2x the median income of agents at comparable brokerages. They need to heavily maintain marketing spend to grow market share in competitive markets. These factors combined are why Redfin’s operating margins per agent, even during periods of high transaction volumes, are sub-10%.

Sidenote: Redfin Agents vs. Realtors

Full service agents only eat what they kill — no sale, no commission. Commissions also mean full service agents will get paid more for higher sale prices, whereas Redfin agents earn a flat fee. If you’re a top producing real estate agent, you will outperform by working on commission. If you’re a rookie without an existing client base, you will likely earn more at Redfin. The heaviest hitters in a locality aren’t working for Redfin.

That doesn’t mean Redfin is an entirely poor choice for buyers and sellers. Redfin’s lower-cost solution is better suited for certain customers. The company’s listing data, quality search experience and high web traffic serves as a valuable source of leads that can be converted to clients.

Redfin also refers listings to third-party brokers who pay 30% of their commission fee to Redfin. Naturally, this is a much higher margin business.

Saving Grace

Redfin has ~$115mm of home inventory, of which $97mm is slated to be sold as part of the ongoing RedfinNow winddown. The sale of this inventory, even if completed at discounted prices, will give Redfin additional runway to wait out the market storm and resolve operational issues.

Other possible avenues to extend runway would be monetizing other parts of the business, such as the acquisitions of Bay Equity and RentPath. Selling these businesses would allow Redfin to extend its runway further while it right sizes its cost structure. The company would realize a significant loss on these purchases but may be able to deal with its 2025 maturity.

Cap Stack Outlook

Redfin spent heavily on acquisitions to enter new businesses and hired aggressively during booming markets. Flush with a high stock valuation and easy access to capital, the company lacked cost discipline. Rising rates, persistent increases in cost of living, and an uncertain economic picture have resulted in a slower housing market. Due to its high personnel costs, marketing spend, and network overhead, Redfin is bleeding out. Fast.

If the market does stabilize, Redfin might be able to ride the struggle bus up until the 2025 notes near maturity.

The more likely outcome is that Redfin faces a liquidity crunch within 18-24 months.

The saving grace is that Redfin has $115mm of home inventory that will provide an inflow of cash and help extend the runway. Should they be willing and able, the company could monetize the two non-core businesses acquired in the last two years (taking a substantial loss) and buy more time. Otherwise, the company is heavily reliant on market conditions to dodge a bankruptcy filing.

It’s not all bad. Redfin has 50mm+ unique visitors to its site and a proven model for conversion. The real estate services business can be profitable, as past years have proven. But the Redfin business today has poor unit economics, losing money on every agent except in the hottest of real estate market conditions.

Despite a strong housing market in 2021 and record low rates, Redfin found a way to lose money. We anticipate Redfin’s treasured goal of growing market share will also lose steam as the impact of layoffs plays out over the course of 2023.

Is Redfin going bankrupt? The Cap Stack opinion is.. Probably.

With that, we will close out our Redfin report with the following parting words for the company: pls fix.

Appendix: Historical Financials

Disclaimer: We are not financial advisors. This content is for educational purposes only and merely cites our own personal opinions. All analysis, including valuation, debt, liquidity, etc. is illustrative in nature and subject to revision.