Icahn Enterprises

Opportunites across the cap stack

Equity represents a fractional ownership stake in a company. Equityholders receive rights such as a share of a company’s profits in the form of dividends, and voting rights. The average investor doesn’t vote, and is by and large a passive participant in the direction of a business. The median market cap of U.S. equities is ~$800 million, which means building an influential equity position in most companies is unattainable for the average investor.

Large positions are reserved for large pools of capital, which means asset managers, family offices, and UHNW individuals.

Investors with larger pools of capital can buy up more shares of a company and exert some degree of influence. Executives generally play ball with investors because they know if enough large investors get together and make a fuss they could lose their jobs.

Investors that focus on building up influential equity positions and seeking change are known as “activist” investors.

Activist investors will quietly buy up minority interests in companies with the goal of gaining influence through their equity position and pushing for changes at the company. These changes could include gaining seats on the board, pushing for changes in management, influencing strategic direction, capital structure management and more.

The Birth of the Activist

87 year-old Carl Icahn is one of the most famous investors in history. He started his career on Wall Street in 1961 as a stockbroker, later pivoting to trading options. In 1968 he went off on his own and started a brokerage firm called Icahn & Company. Icahn & Co. started off as an options brokerage specializing in arbitrage.

How did an options broker progress into becoming one of the most notorious “corporate raiders” of all time?

In the 60s and 70s, Icahn engaged in convertible arbitrage, exploiting inefficiencies between a company’s stock and its warrants or convertible debt. Over time, this strategy evolved to arbitraging closed-end mutual funds and their underlying portfolio.

Mutual funds are just portfolios of securities with money managers at the helm. Open-end funds will issue or repurchase shares to meet demand from investors, and trade at the fund’s Net Asset Value (NAV) per share.

Closed-end funds on the other hand have a fixed number of shares, and shares are purchased from other investors the same way you would buy or sell a stock. As a result, closed-end funds can trade at a discount or premium to NAV.

Icahn would long closed-end funds trading at a significant discount to NAV, and short the securities in their portfolios. This hedged out the market risk of their position. As the discount to NAV compressed, Icahn & Co. profited. The risk was that the discount widened, forcing Icahn to close out positions at a loss.

To close the gap between NAV and the price of the units of the mutual funds, Icahn would push for the liquidation of these funds. Even the prospect of liquidation could cause the market to reprice the units and generate profits for Icahn.

Over time, apparently Icahn & Co. realized the same line of thinking could be applied to undervalued companies. Icahn the activist was born.

Icahn sought to “control the destinies” of companies by buying significant stakes in their equity and pushing for actions that could yield profits for his stake, such as the sale or liquidation of the company, or the purchase of Icahn’s shares.

Proxy Fights

A key tool in the activist investor arsenal is the proxy fight.

Proxy fight: A contest among shareholders to make major changes at a corporation, such as the election of the Board, M&A, asset sales, and more. Shareholders cast their votes using their shares to a “proxy” (representative) who votes on their behalf towards a specific action.

A proxy fight is what brought Icahn an early win in activist investing. In 1977 Icahn began building a position in appliance manufacturer Tappan, a company he believed was undervalued and a strong candidate for a takeover. After Icahn’s discussions with management about selling the company fell apart, Icahn took his fight public and sent a letter to shareholders.

He waged a proxy fight to get himself a seat on the board and push for a sale, merger, or liquidation of the company which he believed was trading at a 45% discount to its share price. Tappan was eventually sold at nearly double the price Icahn paid, netting him a cool $3mm and paving the way for the future of Icahn & Co.

In the decades that followed, Icahn amassed a multi billion dollar war chest from takeovers and activism. Recently, the hunter has become the hunted as short seller Hindenburg Research called out IEP for its poor performance, overstating their marks, and paying an unsustainable dividend.

Icahn Enterprises LP

Icahn Enterprises LP (“IEP”) is a holding company founded in 1987 (began as American Real Estate Partners). IEP consists of various businesses, including Icahn’s investment funds, an energy company, food packaging, real estate, automotive and more.

IEP looks for companies to invest in and aims to realize intrinsic value through a sale, replacement of management, or buyout. IEP also acquires companies for its own portfolio, and invests in the debt of distressed companies.

Icahn structured IEP as a master limited partnership (“MLP”), which gives the general partner (Icahn Enterprises GP) total control over IEP, including electing the Board.

Translation: Icahn has thrown enough captains overboard in his career and knows how to avoid joining them (with tax benefits).

IEP is, for all intents and purposes, Icahn’s very own investment vehicle. Carl Icahn and his son Brett Icahn own 84% of the company. That hasn’t stopped investors from wanting to ride along with the famous investor.

It’s a bit ironic that Icahn has been subject to a public short report on his own closed-end holding company, considering that his arbitrage on the discount to NAV of closed-end funds is where he got his spark for activism.

Is there a comeback story for the 87-year old, or is this the end of the road?

The Situation

A report by Hindenburg Research brought Icahn Enterprises into the discussion. The question is whether the criticisms are warranted, or if Hindenburg was able to use their influence to profit on their shorts while creating a buying opportunity somewhere in the IEP cap stack for the rest of us.

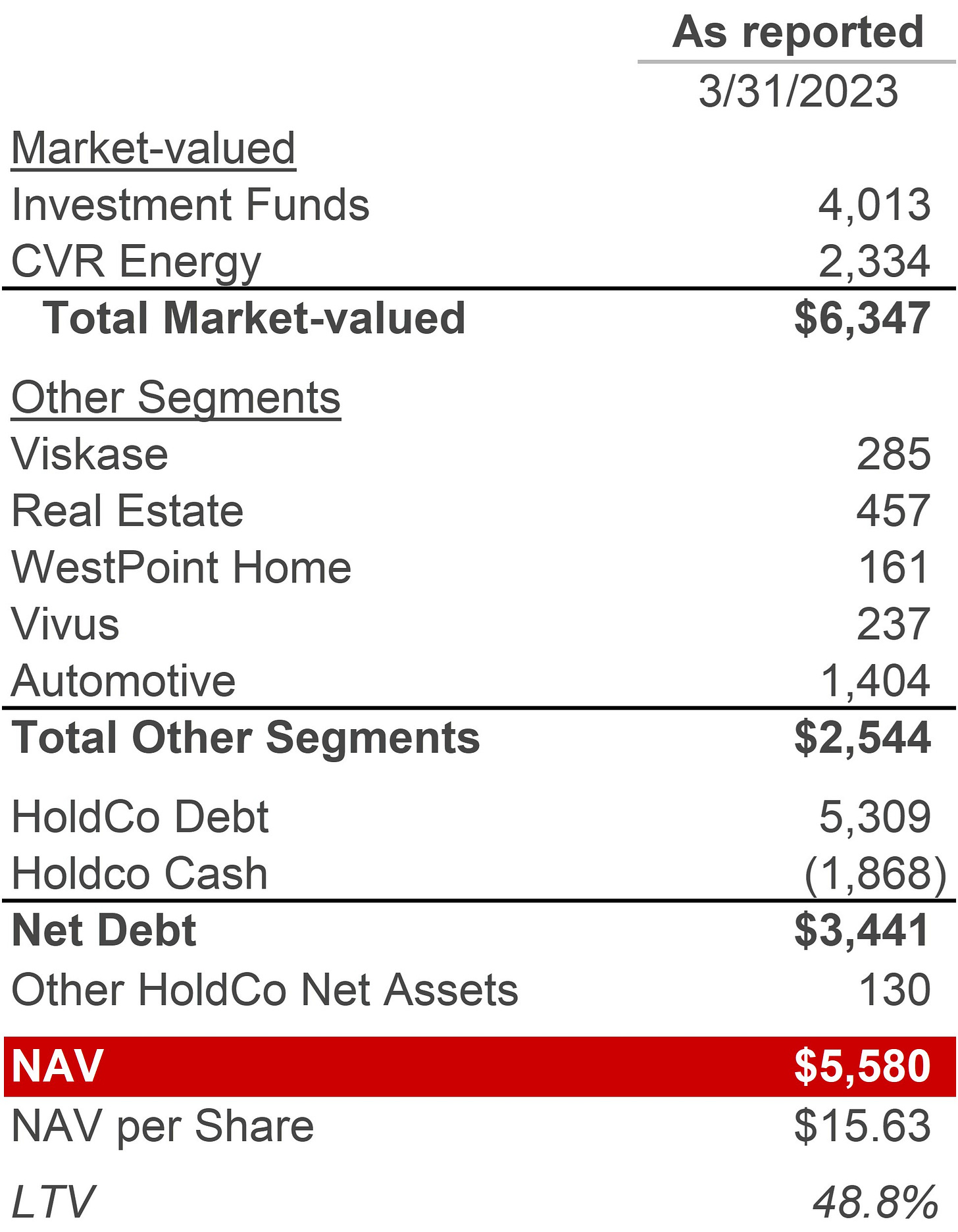

There are some obvious points that stick out. The first being that IEP still trades at a huge premium, even compared to its own “overstated” marks. Indeed, even Icahn gives IEP an indicative NAV of $15.63, while IEP units trade at $26.67 (1.7x NAV!).

If you’re thinking “what an obvious short”, we will have to stop you there. Icahn owns about 85% of IEP, and if sufficiently motivated he could find a way to buyout the remaining units whether that’s on his own or through a strategic partnership. Sure, he may not want to eat the cost of paying such a substantial premium to NAV, but there is a floor price where he would elect to buyout the remaining stake.

We don’t need to do a ton of work to recognize that the stock is overvalued. The question is why?

The answer is two-fold:

Icahn’s star power

Dividend yield

IEP is a chance for investors to participate in Icahn’s investments. His “star power” is critical to maintaining investor interest, which Hindenburg highlights as being almost entirely retail investors. Icahn is likely aware of this, given his participation in a documentary about himself last year (let us know if you’ve seen it).

The other, and perhaps more significant, piece of the equation is the whopping $2 quarterly dividend which now represents a 30% yield for the remaining IEP holders. There is still a steep drop before IEP trades at NAV, so maintaining this dividend is crucial to retain the elevated valuation. To maintain the dividend, IEP has been issuing units at-the-market. While Hindenburg points this out as being “ponzi-like”, the fact remains that Icahn has been able to issue shares at a substantial premium to NAV. You can’t exactly blame Icahn for capturing the premium if it exists!

The Business

IEP looks for undervalued companies to invest in, influence, and potentially takeover entirely. IEP makes distributions to its investors rather than keeping the cash in the business. Icahn own most of the shares and continues to accumulate more as he takes his dividend payments in more shares, paying cash only to the small percentage of outside investors.

The key segments include:

Investment: private investment funds of Icahn and his family members, valued at $4.2B. These funds invest across the cap stack

Energy: Consists of 71% majority ownership of petroleum business CVR Energy which is the GP and 37% owner of CVR Partners LP, a publicly traded limited partnership in the nitrogen fertilizer businesses

Automotive: Retail and wholesale of automotive parts, as well as auto repaid and maintenance

Other: food packaging, real estate, pharma, home products

IEP operates across a wide range of sectors, but not all sectors are equal when it comes to the bottom line.

The only segment that generated material, positive net income in 2022 was Energy. On an Adjusted EBITDA basis, other segments were slightly positive, but Energy was still the only significant contributor. 2023 has been more of the same, with CVR energy putting the team on its back. Automotive segment subsidiary Auto Plus filed for bankruptcy in January 2023. YTD March 31, 2023 returns for the investment funds were -4.1%. 2022 returns were +9.6%.

The Cap Stack

IEP has debt at both the holdco and opco levels.

HoldCo interest is ~$290mm per year, which is unlikely to be covered by cash generation at the HoldCo level. The HoldCo generates cash through dividends and distributions from its subsidiaries and equity/debt financings.

Based on IEP’s NAV calculation the HoldCo has a 48% LTV (2.1x coverage). The HoldCo debt is well covered even in a downside scenario. Interest on the debt may not be covered by distributions, but the company has substantial liquidity to buyback debt at a discount (a $500mm debt buyback program was announced in May) to reduce the interest burden.

Due to the significant ongoing dilution to unitholders, substantial premium to NAV, risk of margin call on units Icahn has pledged for a personal loan, as well as headwinds for IEP’s subsidiaries, we are not bullish on the units. Should the situation worsen, it’s possible that IEP may reduce its dividend which could push the valuation closer to NAV. Icahn is also 87-years old, and his “star power” is key man risk (the ability to invest alongside Icahn is a major draw for investors). There is a succession plan in place to have Carl Icahn’s son Brett Icahn take over as Chairman and CEO.

The HoldCo debt on the other hand is well covered and provides 10-11% yields. A combination of Icahn’s personal financial wherewithal, opportunities to monetize subsidiaries (including the investment segment), a long liquidity runway, and attractive debt coverage means that IEP’s unsecured debt is likely money good. For what it’s worth, Hindenburg later took a short position on IEP’s bonds and seems to have done poorly on that trade.

Disclaimer: We are not financial advisors. This content is for educational purposes only and merely cites our own personal opinions. All analysis, including valuation, debt, liquidity, etc. is illustrative in nature and subject to revision.

This was awesome. I've read every post you've done. Even if you don't get any comments, know that people are still reading and appreciating!